Education Loan

Education Loan for Abroad Studies: Studying abroad can be a life-changing decision, however, this doesn’t come easy. For most students, the idea of studying abroad comes with the promise of a new life experience in an unfamiliar country. For students from low-income families, however, this goal can be out of reach. Those who want to pursue higher studies abroad, but find it difficult to arrange for funds, now have the option to make arrangements for funding their education. In this article, we will cover every detail related to education loans for studying abroad. Be it the process to apply for a loan, eligibility, or documents required for it, we will cover various other aspects related to student loans like Indian banks giving student loans or the role of a guarantor. We will cover every aspect for all those who are looking for an education loan to study abroad.

Check: Best Education Loan Providers in India for Study Abroad

Benefits of Education Loan

There may be times when the family’s income and resources are insufficient to cover the cost of the student’s education. In such cases, banks or other financial organisations must be approached for a student loan (NBFC). You can utilise a student loan to pay for all or part of your education expenses. A student who takes out a study abroad education loan is guaranteed to be able to complete their degree programme without encountering any financial issues.

Loans are frequently seen as bad debt. This expression implies that you are borrowing money for something whose value will diminish over time. An education loan is unique from other forms of loans since it is an investment in the borrower. Through this, you will eventually make far more money than you borrowed.

Eligibility criteria to apply for the education loan

The first and foremost thing is to check whether you are eligible to apply for an education loan or not. Provided below are the general terms and conditions that are usually followed by any bank in the process of granting an education loan. Kindly note that individual banks could have their eligibility guidelines which would have to be adhered to when applying to that particular bank.

- The candidate must be an Indian national.

- If the applicant is under 18 years old, then his or her parents will have to take out the loan.

- The candidate must have a strong academic record.

- The candidate must have been accepted to a reputable overseas university, institution, or college.

- Since banks favour courses that are job-oriented, the applicant’s chosen course must be technical or professional in nature.

- Underwriting norms are the standards set out by loan providers to guarantee that only safe and secure loans are made available. They are also important as they are used to determine whether or not to provide a person with a study loan for overseas study, as well as how much money the firm is prepared to loan and at what interest rate.

What all documents are required for applying for Education Loan to Study Abroad?

Before applying for an education loan, the applicant must be completely aware of the documents required to apply for a study loan abroad. The following documents are required to apply for an education loan for abroad studies:

- Filled application form

- Photographs: Passport-size photographs of the applicant and the co-applicant.

- Photo ID: Photo ID of the applicant and the co-applicant. It can be a PAN card, driving license, Voter ID card, Aadhar Card, or Passport.

- Residence proof: Resident proof of the applicant and the co-applicant

- Academic documents:

- Admission proof: Admission letter shared by the university or college.

- Bank statements: Last six months’ bank statements of the co-applicant

- Income proof: Income proof of the co-applicant (A foreign education loan can be obtained depending on a number of variables, including the financial situation, location, and assets of your co-applicant).

- In the case of collateral (immovable property), it can be flat, home, or non-agriculture land the following documents are required:

- Property title deed

- Building approved plan

- NOC for a mortgage from a builder or society

Document type

Applicant

Co-applicant

Date of Birth

Birth Certificate, Passport, Voter card with DOB, College Passing Certificate, PAN Card, Driving license, Aadhaar Card

Residence Proof (if owned)

Electricity Bill, Municipal Tax Receipt, Share Certificate, or Title Deed (with Flat No.)

Residence Proof (for a rented property)

Registered Rent agreement (with utility bill), Landline phone bill, Post Paid Mobile Bill, Bank statement., Passport, Driving License, Voter ID, and Aadhaar card

Aadhaar

Aadhaar card

PAN Card

Copy of PAN / Form 60 if PAN is not available

Signature

Signature verification from the bank, Passport, Driving License, and PAN Card (all IDs should match with your current signature)

Relationship proof

Passport, Pan, Aadhaar card, Marriage certificate, Birth certificate, Legal heir certificate, Ration card, or any other acceptable documents

Academic documents

10th,12th, UG or PG mark sheets, degree or provisional degree certificate, and applicable entrance test scores

Registration certificates for Professionals (CA, Doctor)

Income proof – Salaried

Documents to establish 3 years of work experience where ever applicable and available

Latest 3 salary slips, Bank Statement of last 3 months, Form 16,

Self-employed:

2 years ITR with the statement of income, Income certificate from Tehsil/collector’s office

Office Address

NA

Form 16/ Salary slip/ Letter from HR/ Snapshot of site/Identity card

Admission proof

Invite/admission letter from University/college and Fee structure

NA

Technical Documentation

Apart from the above-mentioned documents, aspirants also need to have some other technical documents to avail of a student loan.

- Title deed (all the pages to be attached)

- Copy of approved layout plan and permissions case specific

- Revenue document (Khata / Patta)

- BDA ALLOTMENT -NOC AND ALLOTMENT LETTER

- Non Encumbrance certificate

- Possession Certificate (In case the flat is taken from a builder)

- Latest Property tax receipt

- Copy of Prior sale deeds

- Conversion certificate

- Urban clearance certificate (Case-specific)

Check: Student Loan Vs Self Finance – Which is Better to Study Abroad?

Legal documentation

In addition to the standard and technical documents, aspirants also need to have a list of legal documents for getting an education loan.

- Sale /gift/partition deed in favour of customer – Minimum 13 years

- Khata Certificate and extract in the name of the current owner

- Encumbrance certificate – Minimum 13 years reflecting all sale transactions

- Latest Property tax receipt

NOTE: These requirements can vary as per the banks’ regulations.

What is the procedure for getting an education loan for Studying Abroad?

From loan application to approval and disbursement, the entire loan process is time taking, so it is always advisable to apply for a loan a little early. Follow these steps for applying for a student loan:

- Check whether the course in which you are going to study is recognized by the banks or not.

- Figure out how much loan amount you require and how much you are going to arrange on your own.

- Compare the student loan provided by different banks for studying abroad and go for the one which caters best to your needs.

- After finalizing the bank and the loan amount, fill out the loan application form and approach your bank.

- As soon as your loan is approved, the bank will issue a loan document that includes various elements of the loan.

- After signing the loan document, the bank will disburse the amount in installments or as asked by the university.

Top Education Loans Providers in India for Studying Abroad

HDFC Bank

HDFC Bank is one of the largest private banks offering education loans abroad. The maximum loan amount offered by the bank is up to INR 20 lakhs. To avoid the last-minute rush, the bank offers study loans abroad even before the student has secured admission to the university.

ICICI Bank

The bank offers loan upto Rs 1 crore for international courses and the interest rate starts at 9.50% per annum. Fresh property, FD, cross collateralisation with existing mortgage loans are accepted as exceptional collateral. The education loan at ICICI without collateral limit is Rs 20 lakhs for UG courses and Rs 40 lakhs for PG courses.

State Bank of India

SBI offers a maximum amount of INR 30 lakhs as an education loan for studying abroad with a loan margin of 15%. The Interest rate charged on the loan amount is up to 2% on the current base rate of SBI. Further, the loan repayment tenure can be 1 year to 15 years.

Axis Bank

Axis bank offers study loans abroad at competitive interest rates. A margin of 15% has to be arranged by the borrower if the loan amount exceeds INR 4 lakhs. The bank offers a maximum of INR 20 lakhs and covers different costs like tuition, accommodation, and books.

Punjab National Bank

PNB Udaan is the education loan scheme offered by the Punjab National Bank to students going to study abroad. The bank offers foreign education loans for students going to pursue graduate, post-graduate, job-oriented professional, and technical courses. The borrower needs to show a loan margin of 15% for the loan amount of above INR 4 lakhs. Also, the bank offers the base rate as the interest rate on loans taken for pursuing an education at the top 200 universities across the world.

Check: Collateral for Education Loan: Everything You Need to Know

Study Abroad Education Loan from NBFCs (Non-banking financial companies)

Apart from the nationalized banks, student loans can also be availed from non-banking financial companies/institutions (NBFCs). Non-banking institutions offer complete tuition fees to students. Borrowers need to provide collateral as security to the banks as the loan amount is generally more than INR 7.5 Lacs. Students looking for education loans for abroad studies can now have the option to secure a loan from NBFCs. Some of the NBFCs options are:

- Credila: Credila is part of the renowned HDFC bank and provides loans to Indian students wishing to study abroad. The loans are given at a competitive floating rate of interest and can be repaid within 10 years.

- Avanse: Part of the DHFL group, it is considered one of the most popular non-banking financial institutions in India. Student loans from Avanse cover tuition fees up to 100% and other expenses. Apart from this, the interest rates are floating and the processing fee can go up to 1 to 2 percent of the loan amount.

- International Student Loan Program (ISLP): This programme is specially designed for international students who want to study in the US. Through this programme, students can borrow an amount of as little as $1500 and can extend the repayment period up to 25 years. The loan disbursed under this program covers tuition fees and other expenses.

- Global Student Loan Corporation (GSLC): The GSLC offers loans to international students to pursue their higher studies in the US without the requirement of any co-signer.

Contact India’s leading education loan providers through Shiksha Study Abroad

Crowd Funded Companies as Loan Providers

Some companies have a focus on funding for students. These businesses exclusively offer loans to students attending particular institutions in order to maintain security. They provide loans in the local currency of the nation the student will be attending school in. The borrowed money must be returned in the same currency.

Some of the loan schemes offered by Indian banks for Studying Abroad

- SBI Student Loan Scheme: This scheme can be availed by Indian students who have secured admission to any institute in India or abroad. A maximum of INR 20 lacs can be availed at a nominal interest rate and it has to be repaid within 15 years. Also, if the loan amount is more than INR 7.5 Lacs, then borrowers need to furnish collateral as security. The repayment starts after one year of completion of the course.

- SBI Global ED-VANTAGE Scheme: This loan can be availed by Indian students who wish to pursue a full-time course abroad. Students can avail of a loan of up to INR 1.5 crore and have to repay it within 15 years. The borrowers need to provide collateral to secure this loan and will have to start repayment after 6 months of completion of the course.

- HDFC Bank Education Loan for Foreign Education: This loan scheme can be availed by Indian students who wish to pursue studies abroad. The maximum amount available in this scheme is INR 20 lacs at a nominal rate of interest. Also, it offers tax benefits to the borrower and it can be sanctioned before admission as well.

- Oriental Bank of Commerce Education Loan for Study in India and Abroad: This loan scheme is offered to students who wish to pursue their higher studies in India or abroad. If the student wishes to pursue his studies in the US, then the amount of the loan will depend on the fee structure of the institute they have applied to. The highlight of this scheme is that it does not charge a prepayment penalty from the borrowers and also gives insurance coverage as well. The margin for the loan amount exceeding INR 4 Lacs is 15% on the loans taken for studying abroad.

Apart from this, there are more student loan providers in India for studying abroad.

Things to remember while taking an Education Loan for Abroad Studies

- Moratorium period: This is the time during which the borrower need not make any repayment to the bank. This period varies from bank to bank and could last up to some time after completion of the course.

- Loan Margin: Usually, banks do not provide the complete amount i.e. 100 percent of the money needed to fund the education. The majority of the public sector banks issue 90% of the total amount, the remaining 10% has to be arranged by the aspirant himself.

- Effect of Exchange Rate: Always calculate the amount which you will be receiving at the time of disbursement, as any change in the exchange rate can affect the amount you will be receiving.

UGC’s Educational Loan Scheme

The University Grants Commission has come up with an education loan portal called ‘Vidya Lakshami’ which has been developed under the guidance of the Department of Higher Education (Ministry of Human Resource Development), Department of Financial Services, (Ministry of Finance) and the Indian Banks Association (IBA). Loans up to Rs 15 lakh can be provided to students for studying overseas. Upto Rs 4 lakh, there’s no need for collateral or margin. Also, the interest rate cannot go beyond the Prime Lending Rates (PLR). As far as loans above Rs 4 lakh is concerned, the rate of interest cannot exceed PLP plus 1%. The period of repayment remains between 5-7 years. After the studies are completed, a grace period of one year can be provided.

Education Loan: Education loans, sometimes known as student loans, are advances made to students by banks or other financial organisations to help cover the costs of their higher education. High-achieving students are provided financial help to attend universities abroad under this unique loan programme. Every student wants to go overseas to further their studies. Beautiful scenery, cutting-edge infrastructure, the best education system, and the promise of a better way of life are just a few of the things that tempt students to leave the comfort of their homes for distant places. All of this comes at a cost, though. Students’ aspirations to pursue higher education overseas are sometimes shattered by universities’ expensive tuition fees and students’ disproportionately high living expenses when compared to India. Scholarship Programmes and similar initiatives by various private and public institutions have made studying abroad possible for limited students who possess the gift of the brain, leaving the majority out.

Also, the accelerating education expenses, rupee depreciation, as well as inflation, have resulted in applicants searching for clever ways to deal with their overseas study expenses. It is here that Indian public and private banks along with other financial institutions have stepped in to provide Education Loans to students of all calibres to pursue their dream of studying abroad by providing them with financial assistance. However, there is a stringent eligibility criterion that has been laid down by financial institutions for student loan schemes and it is very important for students to satisfy them to be eligible for Education Loans for studying abroad.

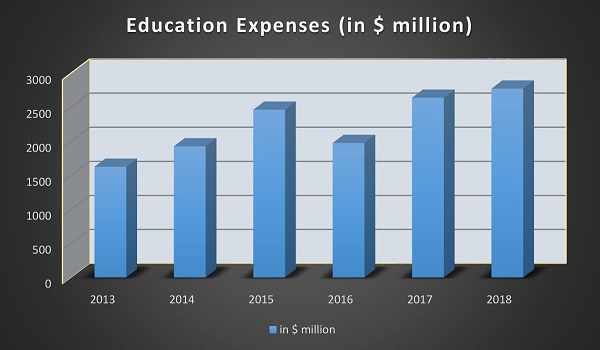

It has been observed that over the past ten years, a higher number of students in India have been taking education loans.

EMI and Interest Rate on Education Loan provided by popular Indian banks

| Bank Name | EMI (Rs 20 lakh Education Loan) | Interest Rate (per annum) |

|---|---|---|

| SBI | INR 31,472 | 8.30% |

| ICICI Bank | INR 32,688 | 9.50% |

| PNB | INR 31,472 | 8.30% |

| Bank of Baroda | INR 32,026 | 8.85% |

| UCO Bank | INR 32,739 | 9.55% |

| Federal Bank | INR 35,627 | 12.30% |

| Axis Bank | INR 37,149 | 13.70% |

| Canara Bank | INR 32,332 | 9.15% |

Education Loan Eligibility Guidelines

It is important for students to understand the education loan eligibility guidelines and qualify the same, to be able to apply to their preferred money lending institution/bank for their Education Loan. The education loan eligibility criteria vary for different banks. However, some common factors that are taken into account by all money-lending institutions (banks) include:

- The applicant must be an Indian national.

- If the loan applicant is under 18, then his or her parents must apply for the loan on their behalf.

- The applicant must have a strong academic record.

- The applicant must have received admission to a reputable overseas college, university, or institution.

- The applicant’s chosen course must be technical or professional since banks favour programmes that prepare students for employment.

- A graduate, postgraduate, or post-graduate credential must be the aspirant’s goal.

- A strong academic record enables quicker loan approval.

- Full-time students must have a co-applicant, who may be either a parent, a guardian, a spouse, or a parent-in-law (in case of married candidates). The co-applicant needs a steady source of income.

Documents Required for Education Loan

While the formalities vary for different banks while applying for an Education Loan, however, there are a set of formalities that are identical across the board, such as documents that you would require to disclose along with your Loan Application Form. The documents primarily include but are not limited to:

Education Loan Process documents required for Student-applicants:

- Proof of Identity (either): PAN/ Passport/ Driver’s License/ Voter ID card

- Proof of Residence/ Address (either): Recent copy of Telephone Bill/ Electricity Bill/Water Bill/ Piped Gas Bill or copy of Passport/ Driving License/ Aadhaar Card

- Income Proof

- Valid Indian Passport

- Academic Records: 10th Result and 12th Results

- Graduation Result: Semester-wise (if applicable)

- Entrance Exam Result through which admission has been secured including GMAT, GRE, TOEFL, IELTS scores

- Proof of admission: Offer Letter or Admission Letter from the Institution. A conditional admission letter may be considered in the case of studying abroad.

- Statement of cost of study/ Schedule of expenses

- 2 passport-size photographs

- If any previous loans from other Banks/Lenders, then the Loan A/C statement for the last 1 year

Education Loan Documents required from Co-applicants:

- Proof of Identity (any one): PAN/ Passport/ Driver’s License/ Voter ID card

- Proof of Residence/ Address (any one): Recent copy of Telephone Bill/ Electricity Bill/Water Bill/ Piped Gas Bill or copy of Passport/ Driving License/ Aadhaar Card

- 2 passport-size photographs

- If any previous loans from other Banks/Lenders, then the Loan A/C statement for the last 1 year

We have also provided the Income Proof documents that would be required from the Co-applicant as part of the Education Loan process.

Documents required for Income Proof for Salaried Co-applicant/ Guarantor:

- Salary Slip or Salary Certificate of last 3 months

- Copy of Form 16 for the last 2 years or a copy of IT Returns for the last 2 financial years, acknowledged by IT Dept.

- Bank account statement for the last 6 months (of Salary Account)

OR

Documents required for Income Proof for Self-employed Co-applicant/ Guarantor:

- Business address proof (If applicable)

- IT returns for the last 2 years (if IT payee)

- TDS Certificate (Form 16A, if applicable)

- Certificate of qualification (for C.A. / Doctor and other professionals)

- Bank account statement for last 6 months

Check: Eligibility Criteria of Education Loan for Studying Abroad – Documents Required

What will improve the chances of an Education Loan?

To guarantee that students receive financial help, banks are vigilant while evaluating a candidate’s eligibility. The general academic standing of the applicants, their intended course of study, and their present admission status are taken into account before authorising a loan.

- Obtaining a good grade or ranking on the prerequisite examinations

- Showing academic excellence

- Being accepted into a reputable institution of higher learning

- Parents, guardians, and co-borrowers have a solid financial history.

- Showing promise for new employment and revenue growth

Education Loans for Abroad: Education loans are not just required for pursuing higher education in India. One may need a student loan to study abroad. So, if you want to study overseas, you should first know the cost of it there. If you are thinking of moving abroad for higher studies then you must be looking to arrange funds. Arranging funds can be one of the biggest challenges, however, there are leading banks and NBFCs that help students with study loans for abroad. In this article, we will inform you about India’s top education loan providers. There are many banks here which provide education loans for abroad studies. Here, we will discuss both private education loan providers in India as well as government and public education loan providers in India.

Check: Step-by-Step Guide to Education Loans

HDFC Credila

HDFC Credila offers education loans with preferential interest rates for reputed universities. Thousands of students who are studying outside India have obtained funds from HDFC Credila. The admissions and educational systems in India and other nations are familiar to HDFC Credila. HDFC Credila offers specialised solutions with features and high service standards. In contrast to banks, which normally charge a fixed rate for a certain group of students, HDFC Credila offers a range of rates based on the institution, the co-borrower, the collateral security provided, and the student’s academic record. Customized student loans are available through HDFC Credila.

What is covered?

Upto 100% of expenses such as exam fees, living and hostel charges, purchase of equipments/books/uniforms, travel costs, library/lab charges, and purchase of laptops or computers. Please note that only one economy class return ticket between India and the study destination is covered.

Highlights of HDFC education loan for abroad

- The minimum loan amount stands at Rs 1,00,000 and no upper limit has been set by HDFC Credila on the loan.

- Floating rate of interest linked to HDFC Credila’s Benchmark Lending Rate (CBLR) will be the rate of interest.

- At present, HDFC Credila’s CBLR is 12.80% per annum.

- The re-payment for loan interest will begin immediately after the disbursement of the 1st installment of the loan.

- The maximum loan repayment tenure is of 12 years.

- Collaterals accepted include residential houses/flats, commercial properties, non-agricultural land, a fixed deposit assigned in favour of HDFC Credila and HDFC second charge property.

Eligibility

- Indian nationality holder to wish to pursue higher education overseas

- Co-applicant should also be an Indian citizen

- Co-borrower bank account should exist in any Indian bank with cheque-writing facilities

- College admission offer letter should exist

Required Documents

| Completed Application Form | 2 Passport Size Pictures |

| Photo ID | Proof of Residence |

| Academic Documents | Admission Prood (if available) |

| Last 8 months of bank statements of co-applicants | Co-Applicant’s income proof |

| If, collateral – immovable property |

Check: Education Loans for Studying Abroad in 2023: Indian Banks, Interest, and Eligibility

State Bank of India

SBI offers education loans for abroad studies to pursue postgraduate degrees in nations like Italy, Russia, the United States, the United Kingdom, Finland, Austria, Norway, Poland, Denmark, Germany, Ireland, Spain, New Zealand, Canada, Singapore, etc. that are job-oriented for professional and technical graduates. These courses include but are not limited to, MBA, MCA, MS, diploma programmes at reputable colleges, etc. The SBI education loan for abroad pays for tuition, books and equipment costs, exam fees, lab and library fees, caution deposits, travel costs, and more.

Highlights of SBI education loan for abroad

- Up to Rs. 1.50 crore in loans, with a minimum loan amount of Rs. 7.50 lacs

- Favourable interest rate

- Online application process that is quick

- Loan sanction prior to i20/Visa

- Repayment through EMI upto 15 years

- Tax benefit: Under 80(E)

- Application processing fee is Rs 10,000

SBI offers a moratorium period or repayment holiday of 6 months after the course completion. The borrower has to submit the college admission letter, completed loan application form, course costs, co-applicant details and other KYC documents to the bank.

Required Documents

Class 10th, 12th, Graduation mark sheets (if applicable), entrance exam result | Offer Letter |

| Course expenses schedule | Scholarship letter copies |

| Gap certificate (if applicable) | Passport size picture of student/parent/co-borrower |

| Co-applicant’s asset-liability statement | Last 6 months’ bank account statement of parent/guardian/guarantor |

| Latest salary slip and Form 16 (for salaried people) | PAN |

| Aadhaar | Passport |

| OVD submission |

Axis Bank

Students can seek education loans for abroad studies for technical, professional courses, or career-oriented courses. Axis Bank provides student loans with no maximum amount, starting at INR 50,000, and covering up to 100% of the whole cost of study (including course fees, cost of books, living & travelling expenses) depending on the requirements and qualifications of the individual. The whole process of getting an education loan with Axis bank is hassle-free.

Highlights of Axis Bank education loan for abroad

- No margin on education loans up to Rs 4,00,000

- 15% margin on education loans up to Rs 4,00,000 for abroad studies

- The education loan which you will take can be disbursed within two days after getting sanctioned

- One can also pay the older instalments which are paid towards the course re-financed once the loan is approved

A parent or legal guardian must co-apply for student loans and, if necessary, provide a third-party guarantee or collateral security. Axis Bank may also take into account a LIC policy for 100% of the loan amount, however, it would depend on the circumstances.

Eligibility

- Indian citizenship holder

- Minimum 50% marks in HSC and graduation

- Student should be enrolled in career-oriented programs at the graduate or post-graduate level

- Should have got admission from a recognised institute via entrance exam/merit-based selection process after completing HSC

- Parent/guardian should have a regular income source

Required Documents

| Income Statements | Last 6 months’ bank statement/pass book |

| Offer Letter’s copy with fee schedule | Mark sheets of SSC/HSC/ degree courses/national level entrance exams |

| Proof of Age | Proof of Address |

| Photo ID | Passport size pictures of applicant and co-applicants |

| Guarantor form (not mandatory) |

Punjab National Bank

PNB Udaan is a special education loan scheme for Indian students with great academic records planning to study abroad. The loan is available for students who have got admission for graduate or post-graduate courses varying from diplomas, job-oriented professional or technical courses, CIMA/CPA courses etc. The PNB loan covers university fees, travel expenses, exam fees, lab fees, library fees, book/equipment fees and other related expenses. The applicant for the loan should be an Indian citizen and should have obtained admission to a higher education program in a recognised international college/university through an entrance test or merit-based selection. He/she should also have cleared HSC.

Highlights

- Fees reimbursement paid within 6 months might be taken into consideration on individual merits of the case

- Margin: Up to Rs 4 lakh – None, Above Rs 4 lac – 15%

- Maximum upto 15 years of repayment

- There are no payment charges

Eligibility

- Resident of India

- Should have got admission to a higher education program in recognised institutions outside India via an entrance exam/merit-based selection process after HSC.

Bank of Baroda

For MBA, MCA, MS, and other recognised courses that promote employment generation, a Baroda Scholar Loan is offered. Students who are heading abroad for professional or technical study have the option to apply for an education loan under the Baroda Scholar Loan programme. The student must be admitted into the designated institute and programme in order to qualify for the Baroda Scholar Education Loan in India. The loan limit for specified institutes is Rs 80 lakhs and for non-specified institutes is Rs 60 lakhs.

Highlights of Bank of Baroda education loan for abroad

- Processing fees: 1% (Maximum Rs. 10,000) for loans above Rs. 7.5 lakhs

- For up to Rs 7.50 lakh there are no processing fees

- No margin on loans up to Rs. 4 lakhs

- Free debit card

- There will be no charges for documentation

- No security up to Rs 7.50 lakh

Repayment tenure: Loans taken up to Rs. 7.5 lakhs can be repaid within 10 years and loans above Rs. 7.5 lakhs can be repaid within 15 years

Borrowers can get a holiday or moratorium period of six months to one year after getting employment. Security is not required for loans below the amount of Rs. 4 lakhs. A third-party guarantee is required for loans between Rs. 4 lakhs and Rs. 7.5 lakhs and tangible collateral security are required for loans above Rs. 7.5 lakhs.

Eligibility

- Should be an Indian citizen

- Should have obtained admission to professional/technical programs outside India via entrance exam/merit-based selection procedure

Required Documents

| Applicant and Co-Applicant’s KYC | Academic Documents |

| Admission Proof | Entrance Exam Result (if required) |

| Statement of Tuition Fees | Co-Applicant’s proof of income (if salaried) |

| Last 6 month’s bank account statement | Property document (if applicable) |

Canara Bank

The Canara Bank education loan covers university fees, travel costs, exam fees, lab fees, library fees, book/equipment fees and other related expenses. Education loan has to be taken with a co-borrower and 100% collateral security is required for loans above Rs. 7.5 lakhs. Courses eligible for this loan are Master’s degree under STEM (Science, Technical, Engineering and Management) courses.

Highlights of Canara Bank education loan for abroad

- Maximum loan amount: Need-based finance

- Loan margin: 15% for loans taken above Rs. 4 lakhs

- Repayment tenure: The repayment period is of maximum 15 years

- Security: Not required for loans below Rs. 4 lakhs. For loan amounts above Rs. 4 lakhs, tangible collateral security is required

- Interest rate: Collateral Security 100% and above – 9.4%, Collateral Security 75% to 100% – 9.65%, Collateral Security less than 75% – 9.9%

IDBI Bank

The IDBI education loan covers university fees, travel, exam fee, lab fee, library fee, the cost of computers, book/equipment fees and other related expenses. IDBI Bank sanctions loan amount according to the requirement of the borrower, with no security on loans below Rs. 4 lakhs.

Highlights of IDBI Bank for overseas education loan

- Flexible tenure and loan enhancement facility

- Attractive interest rate

- Maximum loan amount: Up to Rs. 30 lakhs

- Repayment tenure: Maximum of 15 years after the completion of the moratorium period

- Interest rate: Upto 7.5 lakhs – 9%, Above 7.5 lakhs – 9.5%, 0.5% concession for female student

- A third-party guarantee is required for loans between Rs. 4 lakhs and Rs. 7.5 lakhs. An education loan has to be taken along with a co-borrower. 100% collateral security is required for loans more than Rs. 7.5 lakhs

Avanse Financial Services

Avanse offers various kinds of loans like pre-visa disbursement loans, fast-track loans, pre-admission loans, and certificates of availability of funds. Borrowers must submit their KYC documents, course fees, collateral documents, income documents, etc. when they avail of an Avanse education loan. Avanse education loan covers tuition fees, travel costs, living expenses, books /equipment fees and other related expenses.

Highlights

- The loan will get sanctioned within 72 hours

- Students can choose between secured and unsecured loan options

- Interest rate starting from 9.5% and 1% onward processing fees

- The repayment option is flexible

- Loan tenure up to 15 years

- Maximum loan limit can be customized according to the borrower’s requirement

Check: Private Trusts offering Scholarships and Loans for studying abroad

Federal Bank

Federal Bank provides loans that are available for higher education, but not for vocational training or skill development study programmes, in both India and abroad. Meritorious students are given the chance to further their education with the help of the bank thanks to the Special Vidya Loan.

Highlights

- Security is not required. up to 4 lakh rupees.

- There is not much documentation needed.

- No payback is required during the moratorium period, and affordable EMIs are available for repayment.

- Speedy loan approval

- Loan amount upto 20 Lakhs to study abroad

Required Documents

| Identity Proof | Proof of Adress |

| Admission Letter | Academic Qualification Mark Sheets |

| Proof of Fees Structure |

Union Bank of India

The Union Bank of India provides education to students holding excellent academic qualifications in order to pursue technical/higher/professional education in India or abroad. It should be noted that it is mandatory for the parent (s) of the applicant to apply as a co-applicant. If the student is married, his/her spouse/parent (s) or in-laws can act as co-applicant (s). If the applicant does not have parents (not alive) his/her guardian or close relative can act as co-applicant. Also, it is necessary for the co-applicant to be an Indian citizen. Courses covered include PhD courses, Graduation/post-graduation degree courses, CIMA, London, CPA, USA (and other similar institutes) conducted certified degree courses. Please note that overseas Diploma courses won’t be covered.

Eligibility

- Applicant must be holding Indian nationality

- Applicant should have been accepted in an Indian institution or abroad for technical/higher/professional education by clearing the relevant exam and selection procedure

- No maximum or minimum age criteria have been set for this

Highlights

- No minimum loan amount has been fixed for the loan that can be approved under the education loan scheme.

- Only after considering the account margins norms will the need-based finance meet the expenses.

- Expenses covered include hostel charges, tuition fees, examination/library/lab costs, the insurance premium for the student borrower, caution deposit/building fund or refundable deposit, books/equipment/uniforms purchase, computer/laptop costs, travel charges, admission acceptance fee, other expenses.

- Students will have to repay the loan amount within 15 years (after the course and moratorium period).

Required Documents

| Application form and credit information | KYC documents |

| Income Proof (for salaried) | Last 6 months bank statement |

| Property documents | Additional Documents |

Education is widely regarded as one of the most integral parts of our lives. It can open many doors for a person and it shapes the path they take in their future. Education has been seen as a source of wealth and those who have the capability to attain quality education are often very successful in their lives. The biggest wealth one generates through education is knowledge, however, it is not just education but quality education that matters. In order to get a quality education, more and more students are going abroad. According to recently released data from RBI, spending on tuition and hostel by Indian students going abroad has increased 44% from $1.9 billion in 2013-14 to $2.8 billion in 2017-18 and is expected to increase by 1.8 million approximately by 2024 academic session. The exorbitant increase proves that people are preferring to pursue skill education abroad.

Acquiring quality education is becoming expensive day by day. Arranging for funds to finance an education abroad is one of the biggest challenges one faces. People overcome this hurdle with the help of student loans. Also, there are numerous institutions one can think of while taking an education loan. The biggest chunk of the market is with public sector banks, however, private banks and NBFCs (non-banking financial companies) are also catching up rapidly. Public sector banks offer low-interest rates, no pre-payment charges, and low processing fees. Whereas, private sector banks provide enhanced customer service, high-interest rates (as compared to public sector banks) and faster processing. Contact India’s leading education loan providers through Shiksha Study Abroad.

(Source: Reserve Bank of India)

Government Banks vs. Private Banks for Education Loans to Study Abroad

There is a huge difference when taking a student loan from a public sector bank or a private sector bank. The interest rates are the very first thing we consider when discussing student loans. The interest rates supplied by public banks are consistently lower than those offered by private lenders, as individuals who have done their homework on school loans may already be aware. Additionally, we may bargain with private lenders about processing costs and loan insurance percentages in addition to interest rates. Students without good negotiating abilities can pass on a better offer. Private lenders almost always demand greater processing costs than public institutions. Public banks may levy a processing fee for an international student loan that might be anything between zero and ten thousand rupees. In this article, we’ll compare the difference between taking a student loan from a government bank (SBI, PNB, Canara, Syndicate Bank) or a private bank (ICICI, Yes Bank, Kotak Mahindra Bank, HDFC).

Factors | Government Banks | Private Banks |

|---|---|---|

Interest Rates | Any change in repo rate by the central bank gets a transfer to the customers with immediate effect. | The change in the Repo rate does not result in a decrease of interest rates even for the existing customers. |

Prepayment Charges | There is a huge advantage as it comes to prepayment charges, as public sector banks do not charge levy any prepayment charges. | If the borrower wants to prepay the loan then private banks generally charge 2% of the remaining loan amount as they do not want to lose out on the interest they are earning. |

Prepayment Period | Generally, there is no such condition. The borrower can repay the complete loan amount whenever he/she arranged it. | Usually, the borrower cannot repay the loan before completing 6 months of his/her loan. |

Processing Fees | The processing fees charged by banks range between 0.5% to up to 1% of the total loan amount or any fixed amount. The processing fee charged by the government banks is generally low compares to the private sector banks as they do not promote selling through agents. | Private banks can charge up to 2% of the loan amount. Many times, private banks have to give commissions to their agents in order to bring customers, so, the processing fee is higher in private banks. |

Trust Factor | Although this factor doesn’t affect your loan in any way, it is one of the most important factors one considers before taking a student loan. It is said that public sector banks have more transparent policies in comparison to private sector banks. | It is a general thought among customers that private banks have various kinds of hidden charges that they don’t disclose at the time of disbursing the loan. Their policies are driven by profit-making, so, it is always better to read the complete terms and conditions in advance before taking any decision. |

Top Banks for Study Abroad Education Funding

In order to be eligible to apply for an education loan from an Indian government bank, the applicants applying should take the following information into consideration

Eligibility:

- The applicant must be an Indian citizen who lives in India or abroad or is an NRI, OCI, or PIO.

- While an employed candidate must be at least 45 years old, a non-employed applicant may be as young as 35.

- They are eligible to apply for any level of study – undergraduate, graduate, doctoral, etc. in any nation.

- The institution must be either public, private, professional, or international for the student to be enrolled.

Documents Required:

- Admission letter from the institution

- Previous Education Marksheets

- Completed application form with signature

- Indian ID Proof – Aadhar Card / Pan Card

- Bank Statement

- Address Proof

- Salary Slips

- ITR Proof

- Passport sized photograph

- Visa proof

- Valid Passport

Top Banks with Interest Rates Offering Indian Students an Education Loan

As per the revaluation in interest rates in 2022, the interest rates have risen since 2020 quarter.

The following table elaborates a brief estimate upon how much Indian students would be charged while studying abroad:

| Indian Public / Private Banks | Interest Rates | Minimum Loan Amount | Loan Tenure |

|---|---|---|---|

| Indian Public Banks | |||

| PNB Educational Loan | 8.80% to 9.50% | Based on the requirement or need based | 15 years |

| SBI Education Loan | 10.90% | Above 7.50 lakhs | 15 years |

| Axis Bank Education Loan | 13.70% to 15.20% | INR 50,000 | 15 years |

| Bank of Baroda Education Loan | 10.10% to 10.45% | INR 12,50,000 | – |

| Private Banks | |||

| Kotak Mahindra Bank Loan | Upto 16% | INR 7,50,000 | 5-7 years |

| Federal Bank Education Loan | 11.95% | INR 10,00,000 | 15 years |

| HDFC Bank Education Loan | 9.55% to 13.25% | INR 30,00,000 | 15 years |

| Union Bank of India Education Loan | 8.8% to 10.05% | INR 4,00,000 | 15 years |

Note: The interest rates are subject to change as per the regulations of the bank.

A lot of banks (both public and private) have a clause for collateral that is, property or other immovable assets to be submitted with the bank against the loan taken till repayment.

Apart from the public and private sector banks, NBFCs (non-banking financial companies) are also active in the education loan segment. The average loan amount of the NBFCs is more than what the banks disburse as it is their main source of income generation. 90% of the NBFC’s education loan portfolio is over INR 10 lakh i.e. they are preferred for big-ticket loans.

While deciding on a student loan, always consider the above-stated facts and then take your decision wisely. Calculate the overall amount you have to return after adding both the principal and the interest then go for the one which is not heavy on your pocket. And in case you need faster and better service then go for the private sector banks.

Note: Always consult an expert before taking the final decision.

Calculator for Educational Loan EMIs

Before you apply for a loan, figure out how much you can borrow by using the education loan EMI calculator to calculate your monthly payments and the loan’s overall cost. Enter some loan-related details, including the loan amount, length, interest rate, and processing costs to get an estimate of your equivalent monthly payment (EMI). The total interest due and a thorough amortisation chart that breaks down your EMIs into principle and interest payments on a monthly and annual basis are important data.